Major Advanced Candlestick Patterns You Never Heard for BITSTAMPBTCUSD by GoldenEngine

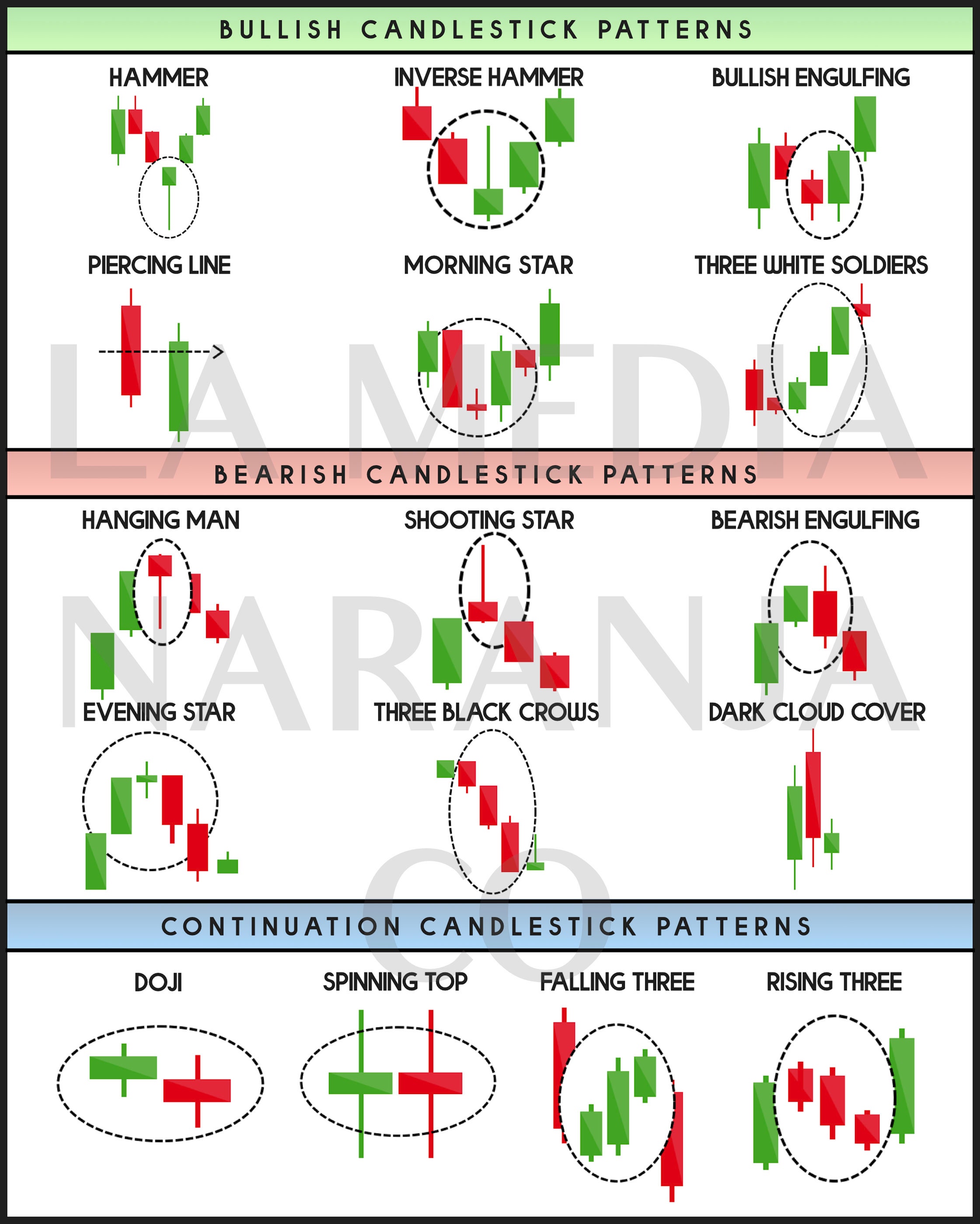

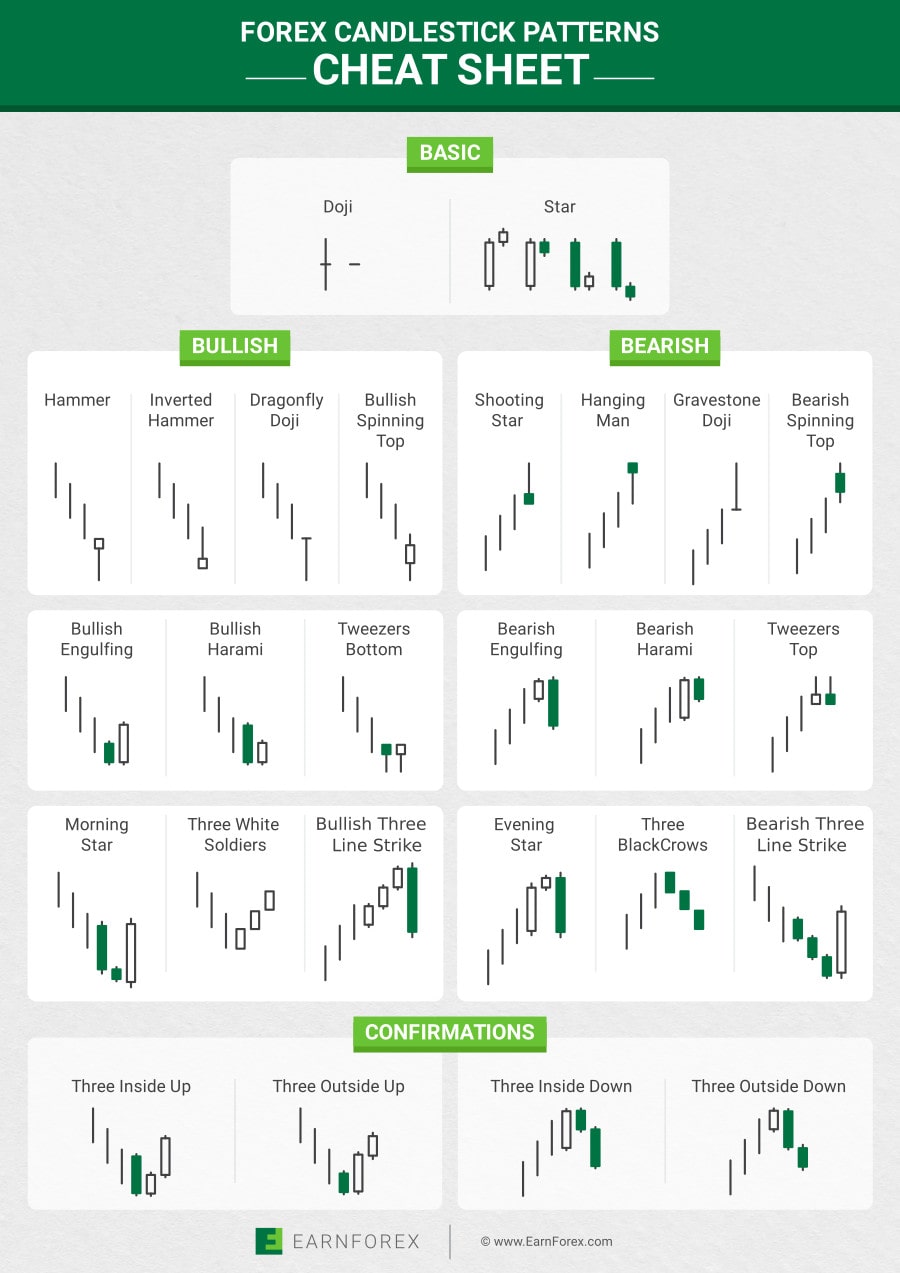

4. Three Inside Up Chart Pattern. The three inside down is a bullish trend reversal chart pattern made of three consecutive candles - a long bearish candle, followed by a bullish green candlestick that is at least 50% of the size of the first candlestick and a third candle that closes above the second candle.

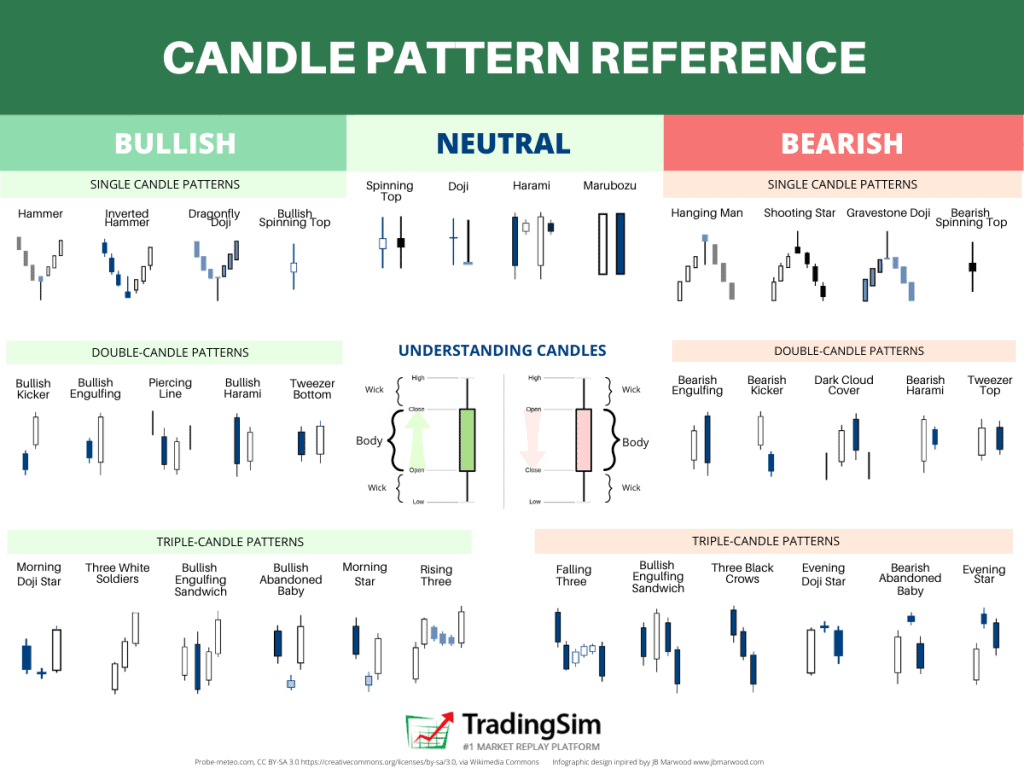

the chart shows different types of candles and candlesticks in red, green, and blue

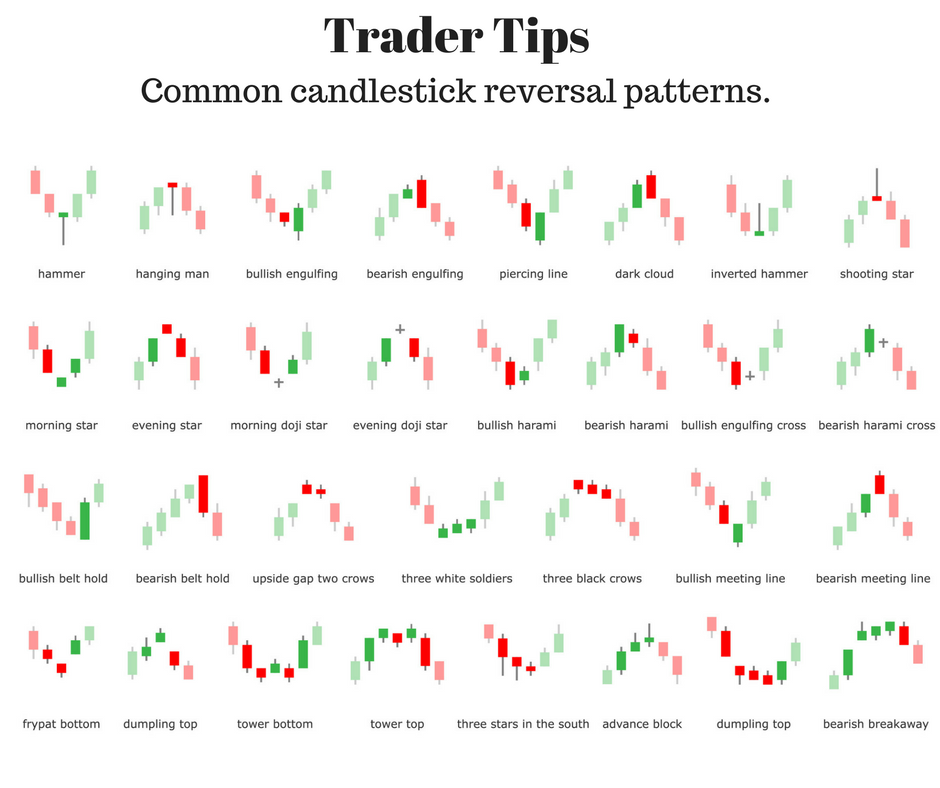

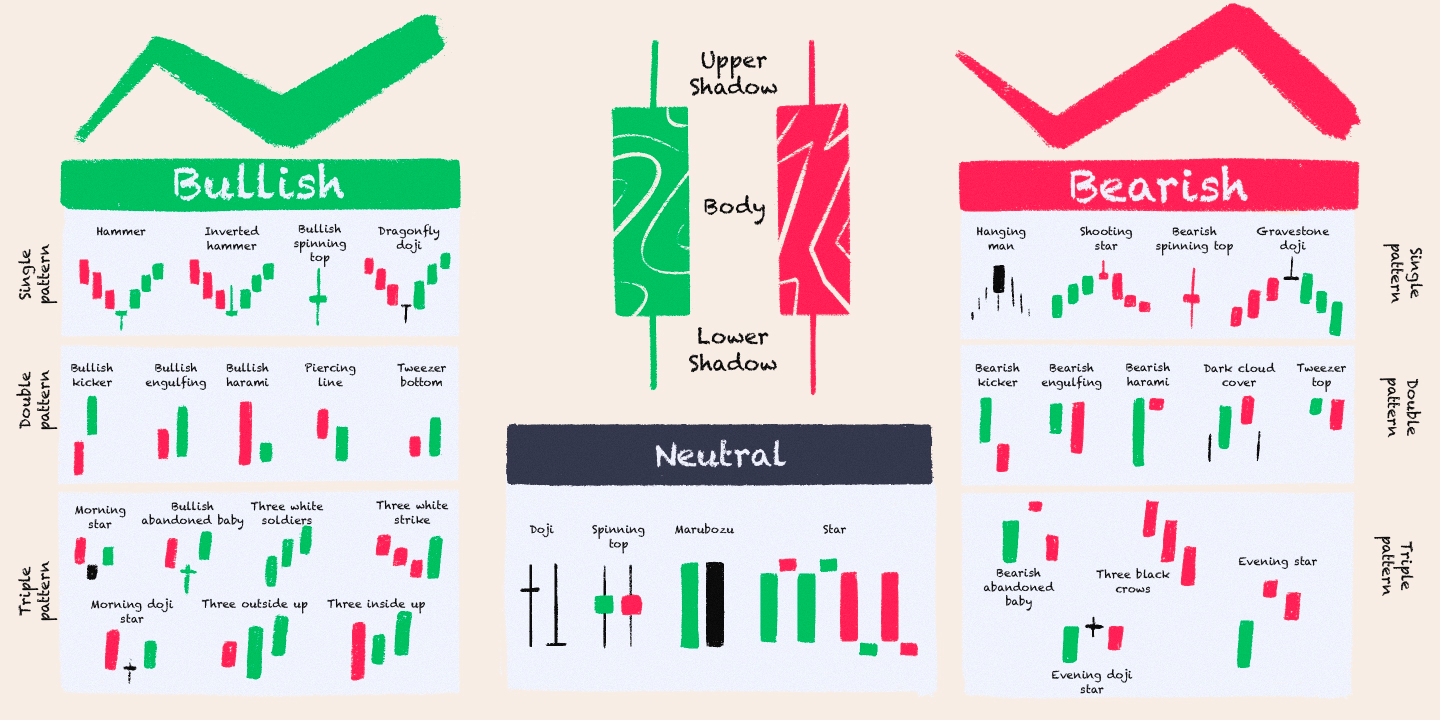

Japanese candlestick patterns are the modern-day version of reading stock charts. Bar charts and line charts have become antiquated. Candlesticks have become a much easier way to read price action, and the patterns they form tell a very powerful story when trading. Japanese candlestick charting techniques are the absolute foundation of trading.

Candle Stick Chart Pattern Pdf ubicaciondepersonas.cdmx.gob.mx

Unlike the previous two patterns, the bullish engulfing is made up of two candlesticks. The first candle should be a short red body, engulfed by a green candle, which has a larger body. While the second candle opens lower than the previous red one, the buying pressure increases, leading to a reversal of the downtrend. 4.

Candlestick Pattern Cheat Sheet Bruin Blog

C o n t e n t s Chapter 1. What is a candlestick chart? Chapter 2. Candlestick shapes: Anatomy of a candle Doji Marubozo Chapter 3. Candlestick Patterns

Candlestick Patterns And Chart Patterns Pdf Available BEST GAMES WALKTHROUGH

In-neck Candlestick Pattern. Definition: The In-neck Candlestick Pattern is a bearish continuation pattern occurring in a downtrend. It consists of a long bearish candle followed by a smaller bullish candle that closes near the low of the previous candle. Signal: Indicates the continuation of the current downtrend.

Candlestick Patterns Explained [Plus Free Cheat Sheet] TradingSim

Morning Star Pattern: The morning star pattern is a bullish reversal pattern. The morning star candlestick consists of 3 candles. The first is a bearish candle, the second is Doji, and the third is a bullish candle representing the buyers' power. Piercing Pattern: The piercing pattern is a bullish reversal pattern.

Candlestick chart patterns cheat sheet pdf aslclip

In the example above, the proper entry would be below the body of the shooting star, with a stop at the high. 5. Indecision Candles. The doji and spinning top candles are typically found in a sideways consolidation patterns where price and trend are still trying to be discovered. Indecision candlestick patterns.

Japanese Candlestick Patterns Cheat Sheet Pdf Candle Stick Trading Vrogue

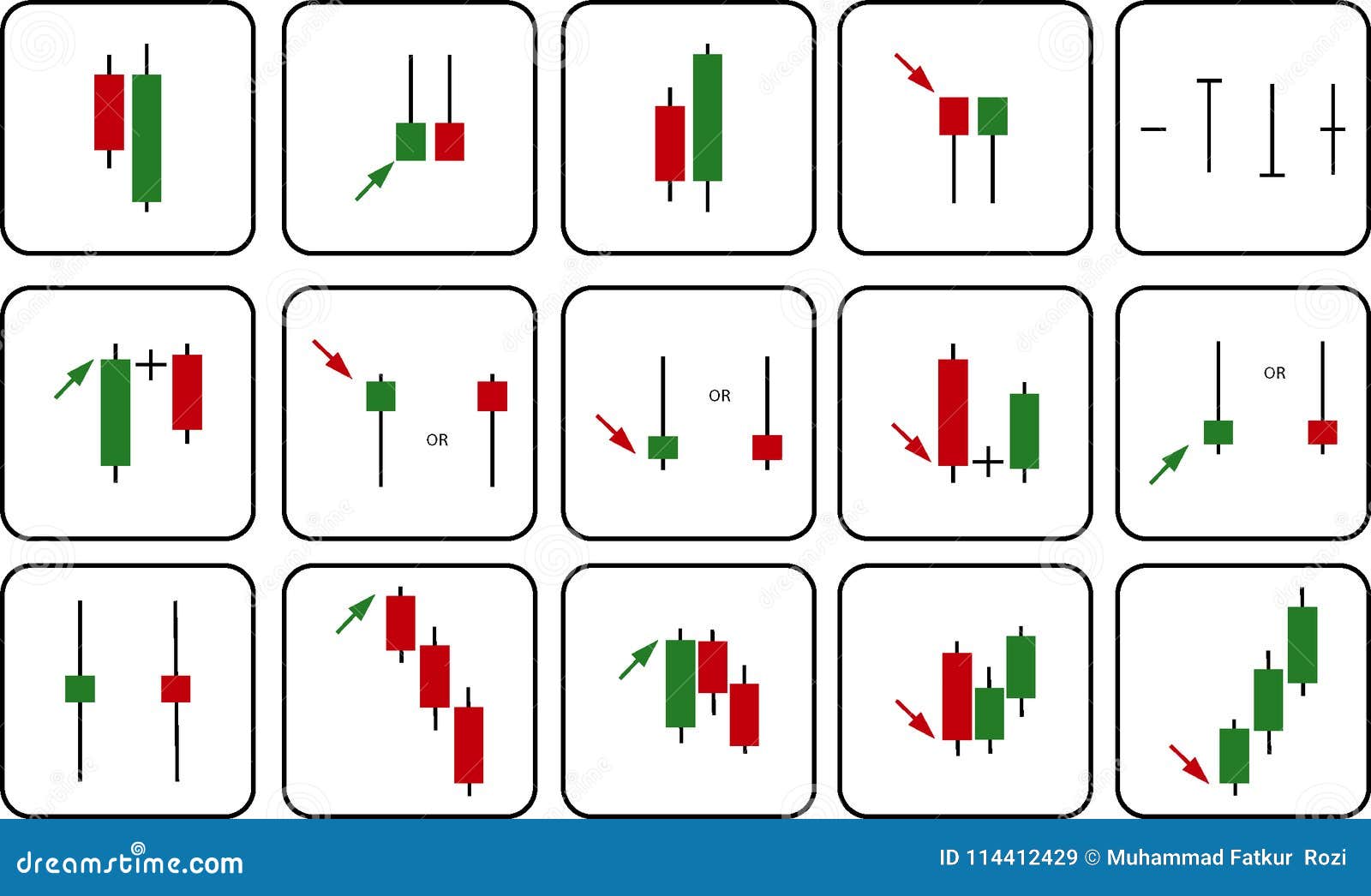

24 CHART PATTERNS & CANDLESTICKS ~ CHEAT SHEET 8 FINAL WORDS Once again, this isn't a guide to read once and then save in your archives. Right now, save it to your desktop, print it out and use it

Candlestick Patterns Charts Meaning, Types, Analysis truongquoctesaigon.edu.vn

an unsuccessful effort by bears to push price down, and a corresponding effort by bulls to step in and push price back up quickly before the period closed. As such, a hammer candlestick in the context of a downtrend suggests the potential exhaustion of the downtrend and the onset of a bullish reversal.

Candlestick Chart Pdf mzaeryellow

1 | P a g e A HANDBOOK OF TECHNICAL ANALYSIS CONTENTS Introduction 3 CHAPTER - 1 5 Types of Charts 5 1.1: Line Charts: 6 1.2: Bar Charts: 7 1.3: Candlestick Chart: 7 CHAPTER - 2 9 Trends 9 2.1: Market Trend and Range-Bound Consolidation: 10 2.2: Trendline & Channels: 12 2.3 Role Reversal: 14 2.4: Channels 14 CHAPTER - 3 16 Volume 16 CHAPTER- 4 19 Classical Chart patterns 19 4.1: Head and.

Forex Candlestick Patterns Cheat Sheet

30. Upside Tasuki Gap: It is a bullish continuation candlestick pattern which is formed in an ongoing uptrend. This candlestick pattern consists of three candles, the first candlestick is a long-bodied bullish candlestick, and the second candlestick is also a bullish candlestick chart formed after a gap up.

Candlestick Patterns Bruin Blog

Dragon Fly DOJI - A Doji with the open and close at the bar's high. Long Legged DOJI - A Doji with long upper and lower shadows. The Individual Candles. Spinning Top - A bar with a small body and small range, after a multi-bar move. High Wave - A bar with a small body and wider range, after a multi-bar move.

Forex Candlestick Patterns Cheat Sheet

6 Strategies For Pro˜ting ith apanese Candlestick Charts Doji, meaning "mistake" in Japanese, is a candlestick with opening and closing prices at the same price level or very close; rather than a rectangle, the real body is a horizontal

Candlestick Patterns And Chart Patterns Pdf Available BEST GAMES WALKTHROUGH

Identify the various types of technical indicators including, trend, momentum, volume, and support and resistance. Identifying Chart Patterns with Technical Analysis. Use charts and learn chart patterns through specific examples of important patterns in bar and candlestick charts. Managing Risk with Technical Analysis.

printable candlestick patterns cheat sheet pdf Google Search Stock chart patterns

A candlestick pattern is a visual representation of price movements in a financial market, commonly used in technical analysis. Candlestick charts display price action for a given time period using individual candlesticks that represent the opening, closing, high, and low prices.

Candlestick patterns dictionary Candlestick patterns, Candlesticks, Stock chart patterns

Candlestick patterns are one of the oldest forms of technical and price action trading analysis. Candlesticks are used to predict and give descriptions of price movements of a security, derivative, or currency pair. Candlestick charting consists of bars and lines with a body, representing information showing the price open, close, high, and low.